How To Enter Expenses In Quickbooks | Quickbooks Number:- +18772499444

How to Import Invoices into QuickBooks Online (UK, AU, CA, IN, FR & Other Regions)?

You can import invoices from text files or Excel spreadsheets directly into QuickBooks Online using Excel Transactions software.

Connect your QuickBooks Online to Excel Transactions App from QBO AppStore by clicking the "Get App Now" button.

Click on "Upload File" Menu and upload your file

Select your file and spreadsheet which has the invoices that you want to import

Select the QBO entity as Invoices

Set up the Mapping of the columns in your invoice import file to the corresponding fields in QuickBooks (Refer below Section)

Click Import and your invoices will be directly added to your QuickBooks company

The important step in the import is to map your file headers to QuickBooks Field in Step 3 of the import.

You need to map your file headers to "Excel Transactions" fields.This mapping will enable us to import your transactions properly into QuickBooks company.

In the mapping screen, we have the "Preview Mapping" button which can help you to visualize your current mappings per the QBO screen with your file headers.

Please refer basics of field mappings for more info How To Enter Expenses In Quickbooks. If you have any confusion or doubts, feel free to drop

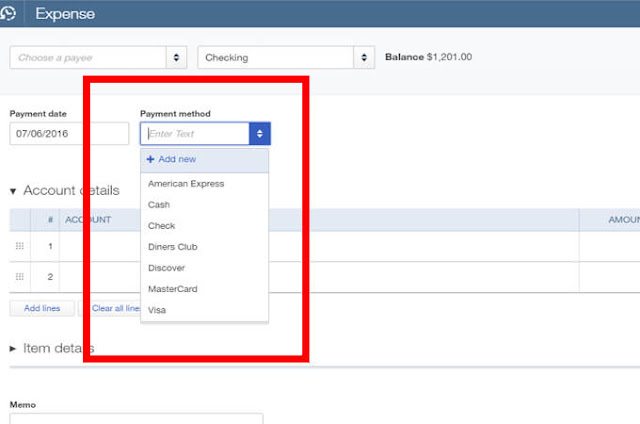

Diligently recording your business expenses ensures that your accounts are accurate and can help you to reduce your tax liability by offsetting revenue and profits against costs. To record business expenses in the QuickBooks business accounts program, use the application's "Enter Bills" feature to record all business expenses and assign them to the correct expense category, such as utilities, travel costs or marketing.

1. Launch the QuickBooks Support program, then sign in with your username and password.

2. Click "Vendors" in the main menu at the top of the screen. Select "Enter Bills" from the pull-down list of options.

3. Click the "Down Arrow" button next to "Vendor" and choose an existing vendor from the list. Alternatively, click to select "Add New" and type a new vendor. For example, enter the name of an ad agency or buyer if you want to record an advertising expense in your marketing expenses account.

4. Enter the date of the expense and the vendor's address in the applicable fields. Type the expense amount in the Amount Due input box.

5. Type the reference number of the expense transaction and any business terms and conditions in the relevant fields, or skip this step if you don't need to record this information in your company accounts.

6. Click the "Expenses" tab and select an account from the pull-down list; for instance, select the "Marketing" expense account option to record a marketing expense transaction.

7. Click "Save and Close" to record the expense and exit the window.

Comments

Post a Comment